Investment Strategy

Creed Equities

STRATEGY

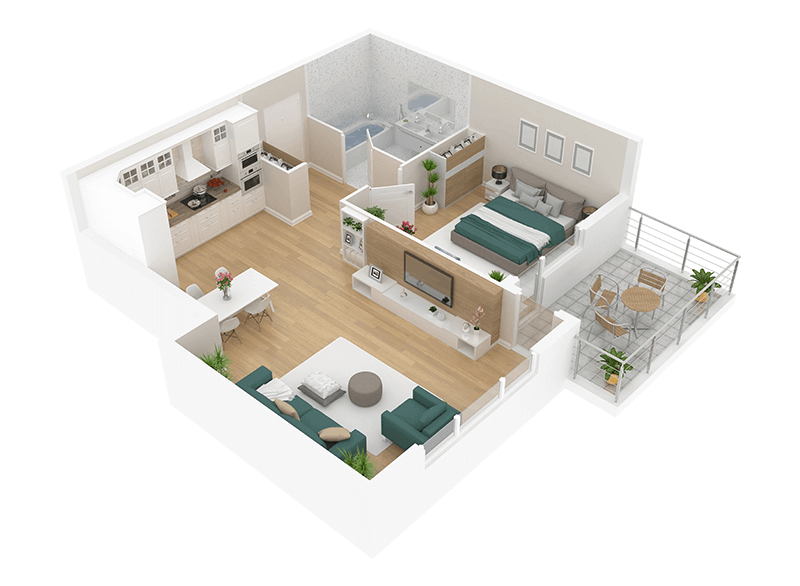

Creed Equity focuses on acquiring and managing commercial real estate assets that will provide an above market standard return for our investors. In order to achieve these returns, we perform in depth analyses, purchase undervalued opportunities, and efficiently and effectively manage all assets under management.

Our primary focus is on Multifamily, Commercial, Industrial, and Mixed-Use assets. These asset classes offer our investors a diverse portfolio, able to mitigate market risk, with a mix of income producing assets and value-add projects.

We are continuously searching for Core, Core Plus and Value-Add assets in primary and secondary cities across the U.S, with a focus on coastal regions. We believe these markets provide the greatest blend of higher return and lower risk assets.

All assets are expertly managed by either our in-house management team or one of our top tier third party managers. Our team acquires assets and implements cost saving strategies to improve the asset’s overall performance.

Our experienced asset management team consistently focuses on efficient performance across all asset types. With decades of experience, we are always looking for ways to maximize every deal under our umbrella.